GT Advanced Technologies Inc (OTCMKTS:GTATQ) reported that it wants to sell its Hyperion operations to an ex-employee, who has given his nod to recruit seventeen GTAT workers, if the offer gets approval of bankruptcy court.

The details

The acquirer firm, Neutron Therapeutics Inc., is run by Mr. Theodore Smick, to whom company recruited from November 2012 to this February at its Danvers facility, where he contributed in development of the technology. Hyperion technology highlights a high-current as well as high-energy ion accelerator that can be deployed in a number of industries.

GT Advanced reported that Smick in association with Stewart Buckley, who owns controlling power in Buckley Systems Ltd., will take care of the project. Buckley had provided magnets for Hyperion before the bankruptcy protection submission.

The impact

The news of proposed sale is encouraging for GT Advanced, as the company had recorded massive losses even after submitting for bankruptcy protection last year. It was not easy for the company to selling the Hyperion technology as out of over hundred interested parties, just two groups proposed a bid to buy the technology.

This August GT Advanced recorded loss of $8.9 million, bringing the paper loss to nearly $400 million in last ten months since it opted for bankruptcy protection in October 2014. The company stated that the monthly operating loss was $4.6 million and nearly $3 million marked as bankruptcy expenses.

The highlights

Despite reported $120 million in cash reserves at the end of August 2015, the company posted a negative equity of nearly $320 million. Also, GT Advanced needs to retire the debt that it owes to Apple Inc. (NASDAQ:AAPL). Its attempts to sell sapphire furnaces have principally been unsuccessful, thus forcing the company to cut its total workforce by as much as 40%. In August 2015, the CEO Tom Gutierrez resigned from his role.

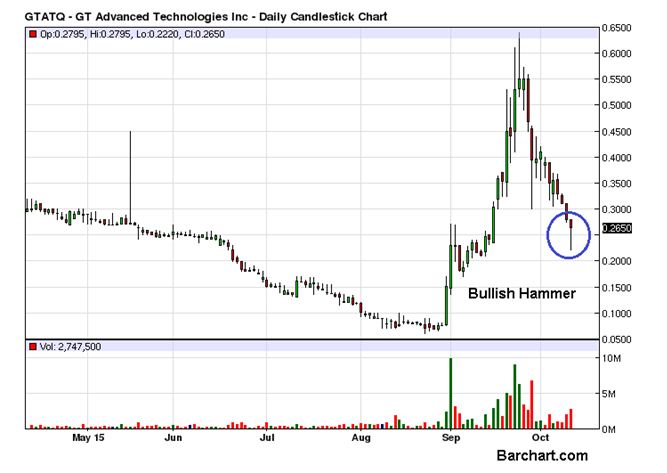

GT Advanced Technologies Inc (OTCMKTS:GTATQ) continued the downtrend as it ended the last trading session with another loss of 5.36% but the day’s price action also supplied the first ray of hope for the bulls, at least in the short term. At the end of the day, the structure of the daily candle shows a long lower tail, indicating a sharp recovery from the day low and some short covering or accumulation at the lower levels. This can be called a Bullish Hammer pattern but to be confident about a bounce, the next day’s price action must provide a confirmation in the form of a positive candle.