Skyline Medical Inc (NASDAQ:SKLN) priced for bankruptcy, caught some good news and emerged from the death spiral this week. Wall Street thinks that SKLN, a developer of the innovative STREAMWAY® waste fluid disposal system for medical applications, has made good progress and could be poised for future growth with an exceptional product. However, SKLN needs capital to make it all happen and you need to know this if you own or intent to open a position in Skyline Medical Inc (NASDAQ:SKLN).

Earlier in August, SKLN announced its second quarter 2016 financial results. Although there were several highlights, the most important point for traders and investors to note is that SKLN reported cash, cash equivalents and marketable securities of $2,140,165 at June 30, 2016. Revenue for the second quarter of 2016 was $85,422, compared with $234,012 for the second quarter of 2015. If that wasn’t enough to curb the bullish sentiment on SKLN, total operating expenses for the second quarter of 2016 were $2,609,937, compared with $1,146,558 for the second quarter of 2015. However, the company made it clear that it intends to increase authorized share capital to support the Company’s capital markets and funding strategy and to effect a reverse stock split. For the uninitiated, in the last SKLN’s annual meeting held in July, the votes to increase the number of authorized shares and to effect a reverse stock split did not exceed half of SKLN’s shares outstanding. The company has arranged a “Special Meeting of Stockholders” on September 15 to vote again on revised versions of those two proposals.

To further bolster its attempts to pacigy shareholders, SKLN on August 24th announced that Glass, Lewis & Co., Inc. and Institutional Shareholder Services, Inc (ISS) recommends that stockholders vote FOR management proposals to 1) increase the number of authorized shares of common stock to 200,000,000 from 100,000,000 and 2) effect a reverse stock split of its common stock at a ratio of between one-for-two and one-for-25 and a proportionate decrease in the number of authorized shares of common stock at the company’s Special Meeting of Stockholders to be held on September 15th.

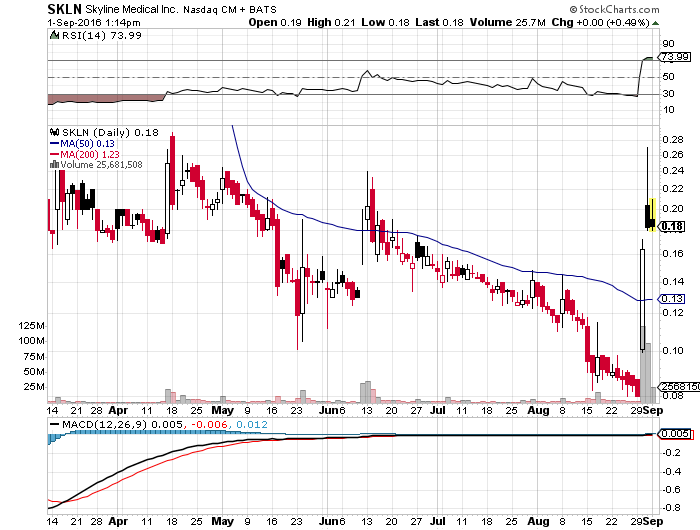

It was on August 30th that the company really gained popularity on Wall street. SKLN announced that it has signed a letter of intent to form a joint venture with Electronic On-Ramp, Inc. (EOR), a Native American Indian, (8a) certified Small Disadvantaged Business owned by a Service Disabled Veteran. This was an excellent move by SKLN’s management team as “EOR’s Partner contracts with the U.S. National Institutes of Health (NIH) and Department of Defense are expected to provide Skyline Medical with access to bid on procurement contracts for up to $550 million or more in federal funds budgeted for health, security, life safety systems support, humanitarian assistance and disaster preparedness.” SKLN needs shareholders approval to make the agreement definitive. If that happens, the joint venture will be in operation by the end of the year. The joint venture, expected to be 51% owned by EOR, will bid to supply medical products for mobile operating rooms, among other activities. Looks like a Fibonacci Retracement play with plenty of upside. SKLN has retracement support at $.17 and $.15 with upside potential to the high $.20’s. Its quite possible that SKLN could breakout further if traders cozy up to it looking for outsized gains.