American Apparel Inc (OTCMKTS:APPCQ) disclosed the details of turnaround plan and confirmed that its clothing line will continue to sell in the U.S. markets. At the company’s hearing in the Chapter 11 bankruptcy case on Monday, American’s lawyer Scott Greenberg outlined the turnaround plan, which is backed by senior lenders.

The details

American Apparel is getting capital to restructure its operations, and in exchange of fresh capital creditors will be entitled to get equity in the revamped company. The outlined turnaround program in no way suggests that the company will close its chain of over 230 stores in the U.S. It will continue to stand by its commitment to produce its clothing line in the country.

This pledge came in retort to comments from Judge Brendan Shannon, who is in control of the company’s Chapter 11 case in U.S. Bankruptcy Court. Judge Shannon said that American Apparel is not a typical brand and in several forms it is a more of a cultural decision. The pledge to U.S. textile manufacturing is barely typical and as per him it is a part of the DNA and part of the message that the company seeks to communicate, share and rely upon.

The plans

Recently, American Apparel’s has been in news following a high-profile battle with former Chief Executive Officer Dov Charney, who was expelled amid allegations of inappropriate conduct. However, the ex-chief executive denies claims of inappropriate conduct on the job.

American Apparel’s new management had a plan for restructuring the declining business operation, reorganizing product line and creating enhanced brand value. The problem is retail executives were hindered by the lack of adequate cash to implement their strategy, and lenders were cautious of proving support to company. Also, by the end of the summer, the company has already defaulted on its senior debt.

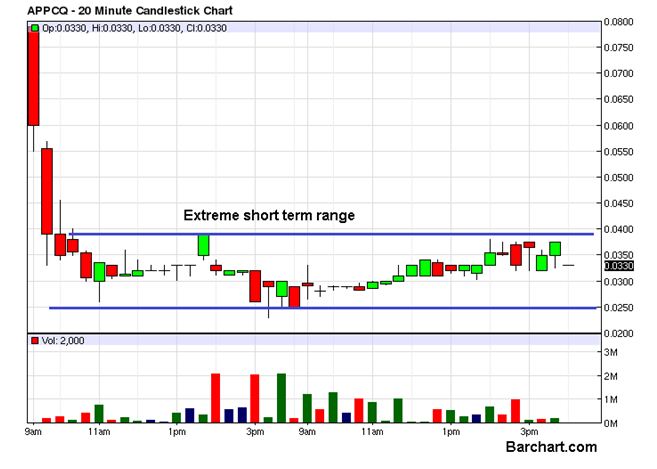

The second day in the exchange was much better for American Apparel Inc (OTCMKTS:APPCQ) as it managed to recover some of the losses it incurred on the listing day. The stock ended the last trading session with a solid gain of 25% with the volume surging to 11 million. The stock is trading at $0.033 now, 52.53% lower from the previous day’s high of $0.079. The damage of the listing day is hard to be undone in a single session and as the intraday chart attached clearly shows, the stock is actually moving in an extreme short term sideways range for the last few hours.