Canada plays host to some of the biggest cannabis companies in the world. Recreational use legalization, in addition to medicinal marijuana, has all but continued to fuel growth in the burgeoning sector. Cannabis sales clocked highs of $1 billion in 2019 with a good chunk of the money generated by some of the biggest players, given their diversified product lines. Analysts believe that sales in the burgeoning sector could clock record highs of $5 billion by 2024.

Below are some of the biggest players fuelling growth in the Canadian Cannabis landscape.

Canopy Growth

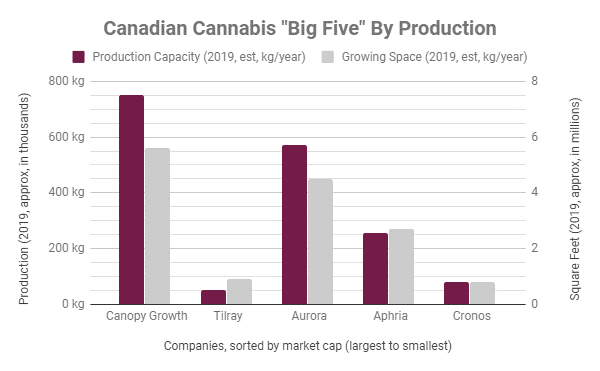

Canopy Growth Corp (NYSE: CGC) is arguably the biggest cannabis company in Canada, with a market cap of about $5.2 billion. The company occupies the top stop thanks to a robust cultivation and processing operations in a 5.6 million square feet cultivation space spanning over 10 growing facilities.

The company boasts of a robust intellectual patent portfolio made up of 11 patents and 270 applications. In addition, Canopy Growth boasts of monstrous cash and short term investment hoard of about C$2.7 billion.

Canopy Growth has already expanded its footprint into the U.S, where it already distributes its products. An investment of close to $4 billion by beverage giant Constellation Brands in 2018 all but affirmed Canopy’s growth status as one of the biggest cannabis players in the world. The investment paves the way for Canopy growth to enhance its operations in the U.S

Cronos Group

With a market cap of about $3 billion, Cronos Group Inc (NASDAQ: CRON) is another company sending shockwaves in the Canadian cannabis landscape. The company accrues its edge in the industry, strengthening its presence on the international scene with production and distribution operations across five continents.

The company’s product mix is mainly made up of hemp-derived CBD for wellness, as well as vape pens. Just like Canopy Growth, Cronos Group has also attracted a massive investment to a tune of $1.8 billion from Altria Group. The company is also sitting on cash and cash equivalents of about $1.5 billion ideal for pursuing strategic initiatives.

Aurora Cannabis

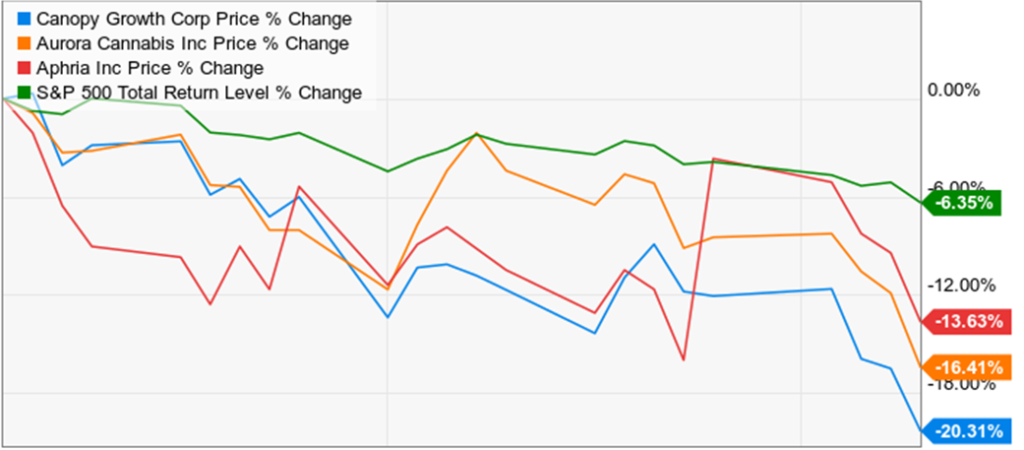

Aurora Cannabis Inc (NYSE: ACB) was once one of the biggest players in the cannabis industry. However, its prospects have dwindled, in recent years, with its market cap shrinking to about $1.3 billion. The company has had to suspend the construction of a mega-production facility in Alberta, Canada. Aurora is also in the process of selling its Exeter facility.

Amidst the misfortunes, it remains one of the biggest players thanks to its diversified product line. The company already has a presence in the U.S as well as in Europe, specifically Germany, where it sells its products.

Aphria

Aphria Inc (NYSE: APHA) has continued to strengthen its prospects in the cannabis industry even as other players continue to struggle. Its market cap has since risen to about $1.3 billion after registering a decline of only 8% in 2019 as other player’s recorded double-digit drops.

The company is poised to be a force to reckon with, after securing licenses for all its three farms from health Canada. Likewise, the company also continues to benefit from revenues from its pharmaceutical distribution subsidiary CC Pharma.

Aphria has completed a number of acquisitions as part of a strategy of expanding its footprint into the U.S. in pursuit of opportunities for growth as well as a wider target market.

Tilray

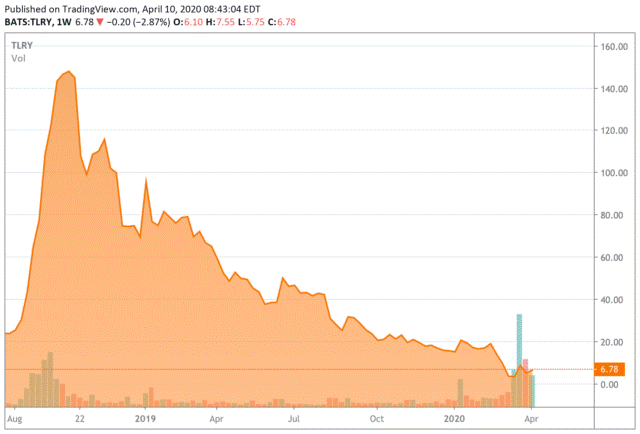

Tilray Inc (NASDAQ: TLRY) is another player that has seen its fortunes turn sour after going public. Its market cap has declined to about $700 million from its glory years. The decline was mostly triggered by high debt levels and high cash burn. Dependence on dilutive equity raises to secure the future also did not go well with the market.

Amidst the massive decline in the stock market, the company has diversified its footprint with operations in Europe and the U.S. It boasts of a robust product line targeting customers around medical cannabis as well as in the adult-use market.