The stock price of NuGene International Inc (OTCBB:NUGN) recorded strong gains on Wednesday and declined marginally in following trading session. It was a brief consolidation as NUGN gained more than 2% on Friday and closed the week high at $1.77. The marginal decline recorded on Thursday didn’t turn sour in the following trading session, which indicates NUGN can gain more in coming trading sessions.

The buzz

The gains recorded last week can be attributed to the encouraging PR which revealed the data of a limited study performed to assess the effectiveness of NuGene’s Light and Bright Gel. In the study, 56% enrollments witnessed a 75% enhancement in skin appearance while 33% recorded improvement of 50%. The subjects of the trial were females in the age group of 30 years to 60 years, with problem of hyper-pigmentation on the face.

The products used in the trial were based on NuGene’s stem cell based technology having a high content of bioactive molecules. In the trial, the data was gathered by an independent investigator who was given with photographic proof demonstrating after and before images of the participants. The study revealed that there was noteworthy improvement in the appearance.

The expert view

Dr. Saeed Kharazmi, the Chairman of NuGene said that Dr. Engelman presented company’s non-hydroquinone based product for hyper-pigmentation aesthetics to the world’s leading aestheticians and dermatologists. The company has a large opportunity to expand in this market. Hydroquinone, a regular constituent of bleaching creams, has been banned in Australia, Japan and the European Union due to possible cancer concerns. Dr. Engelman said that NuGene’s Light and Bright Gel offers a unique approach to hair and skin rejuvenation.

Clinical data from topical application of the unique product yielded positive results. Dr. Engelman added that in his opinion, this was first attainable only by in-office methods.

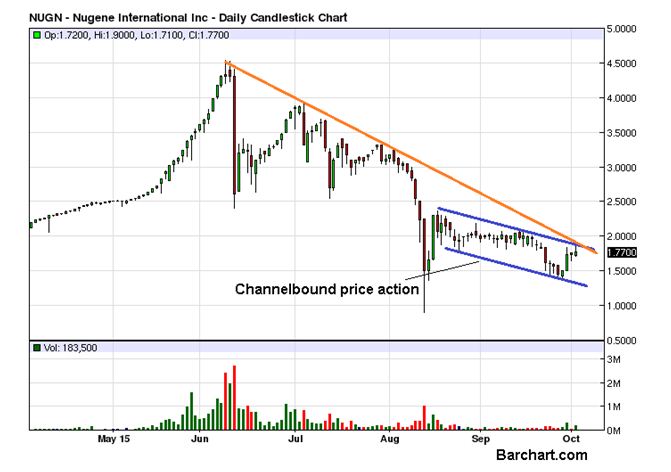

NuGene International Inc (OTCBB:NUGN) finished the last trading session of the previous week on a positive note with a gain of 2.31%. The volume of 183,000 was almost double the daily average of 96,000 but that would not be any consolation for the bulls as the price has just tested a major resistance confluence zone. In the short term, the price has been moving in a downward channel. The upper boundary of that channel and long term down trend line converged at the day high of $1.90 and without any immediate breakout above that level; the price is destined to go down.